In his recent Mid-Year Bold Predictions, Brian Buffini, the chairman and founder of Buffini & Company met with National Association of REALTORS® (NAR)’s Chief Legal Officer Katie Johnson to offer insights on what the future holds for the real estate market. Below is a recap, which includes how he addressed negative headlines, research, and what’s in store for the rest of 2024.

The Good, The Bad, & The Promising

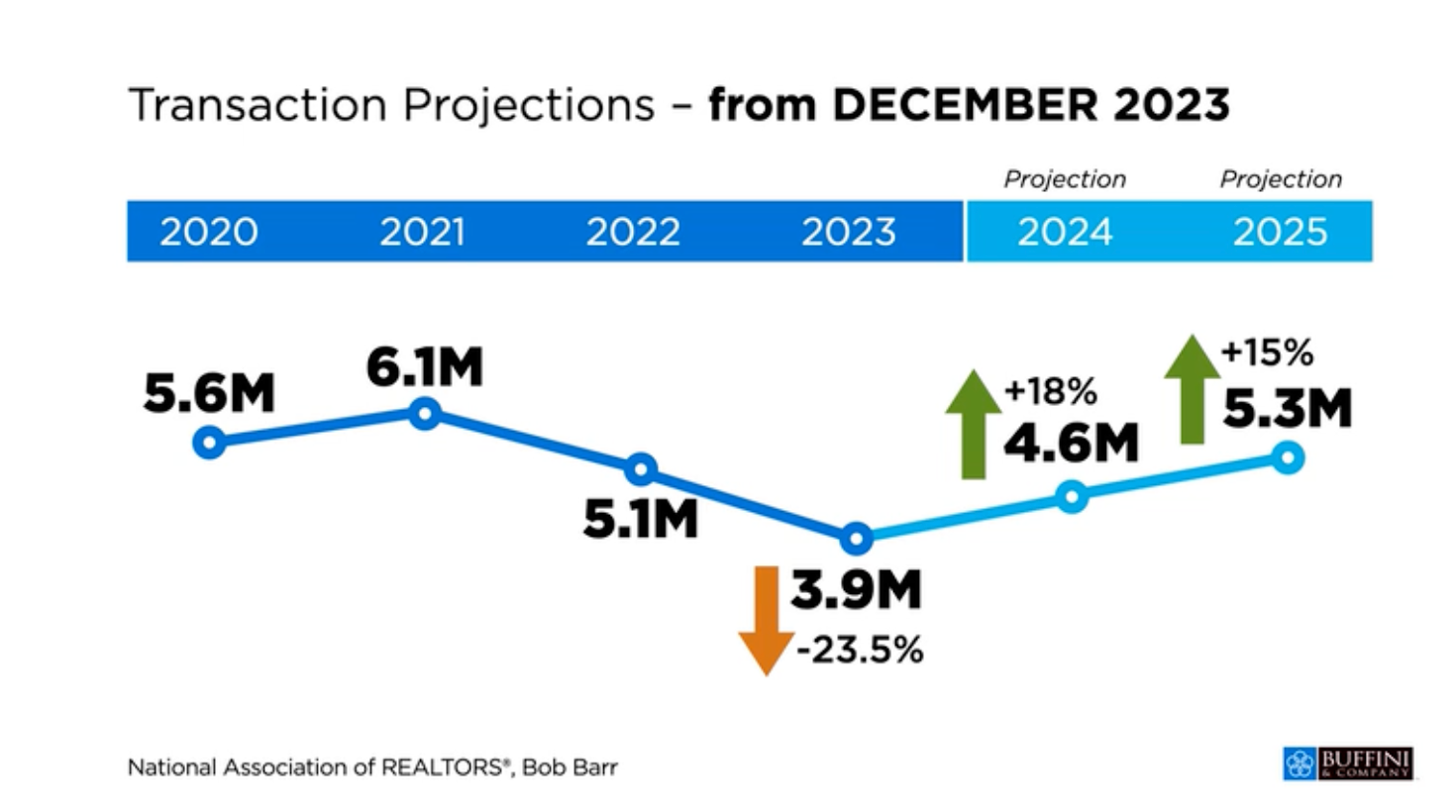

Buffini cut through some of the negative media headlines and shared fact-based research and analysis regarding what is really happening in real estate. Despite that the current real estate market hasn’t been this slow since the mid-90s, he predicted that 40% of sales will happen in the fall of 2024. This is due to a rising inventory as more sellers will be putting their homes on the market and more new home construction is happening in nearly every major market. Furthermore, sales volumes have picked up over the last few months, with 36.7% more homes on the market as compared to last year, giving a more promising market sentiment.

Rising Rents Are Adding Pressure to Buyers

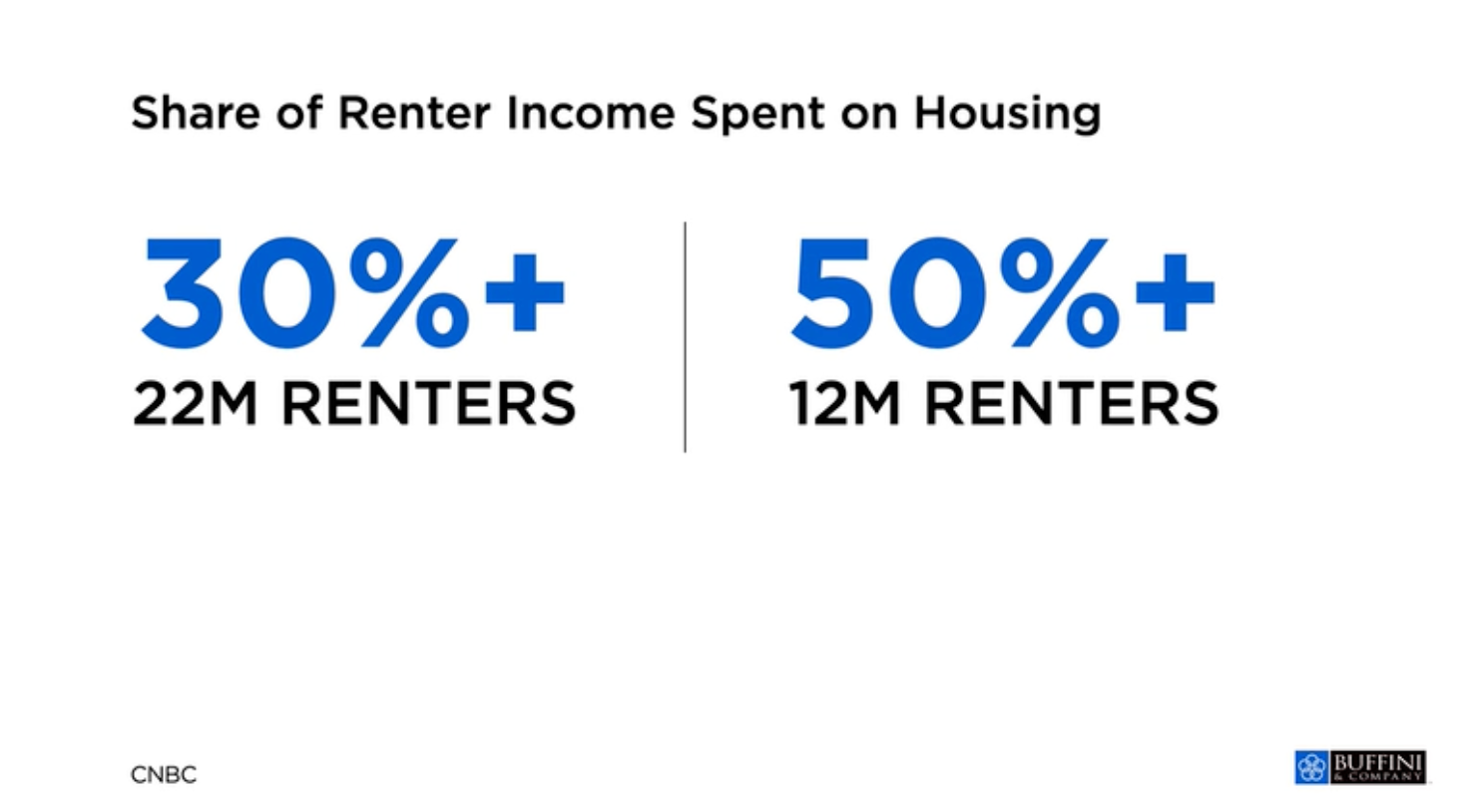

Escalating rents have gradually desensitized both home sellers and buyers to what was once considered "high" prices. As rental costs soar, the perception of high home prices has shifted, making them the new normal. This shift means that inaction isn't a viable option, as the market continues to move regardless. CNBC reported that more than 12 million Americans spend 50% or more of their income on housing.

Consequently, people are still actively selling and buying homes, recognizing that what might have seemed unaffordable in the past is now standard. This dynamic drives continued activity in the housing market, with both buyers and sellers adapting to the evolving economic landscape.

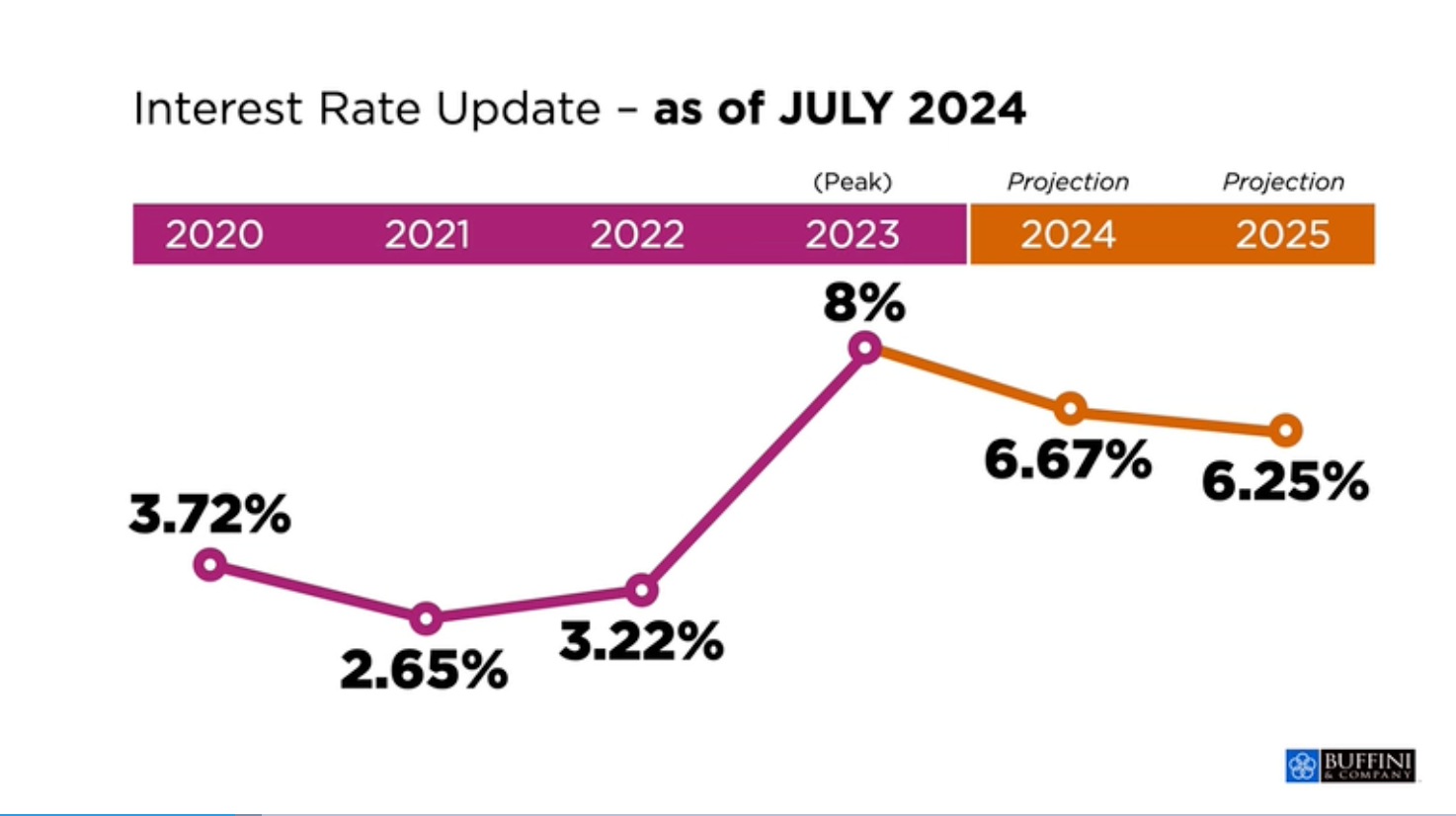

Mortgage Rates Have Been Stubborn But Will Ease a Bit

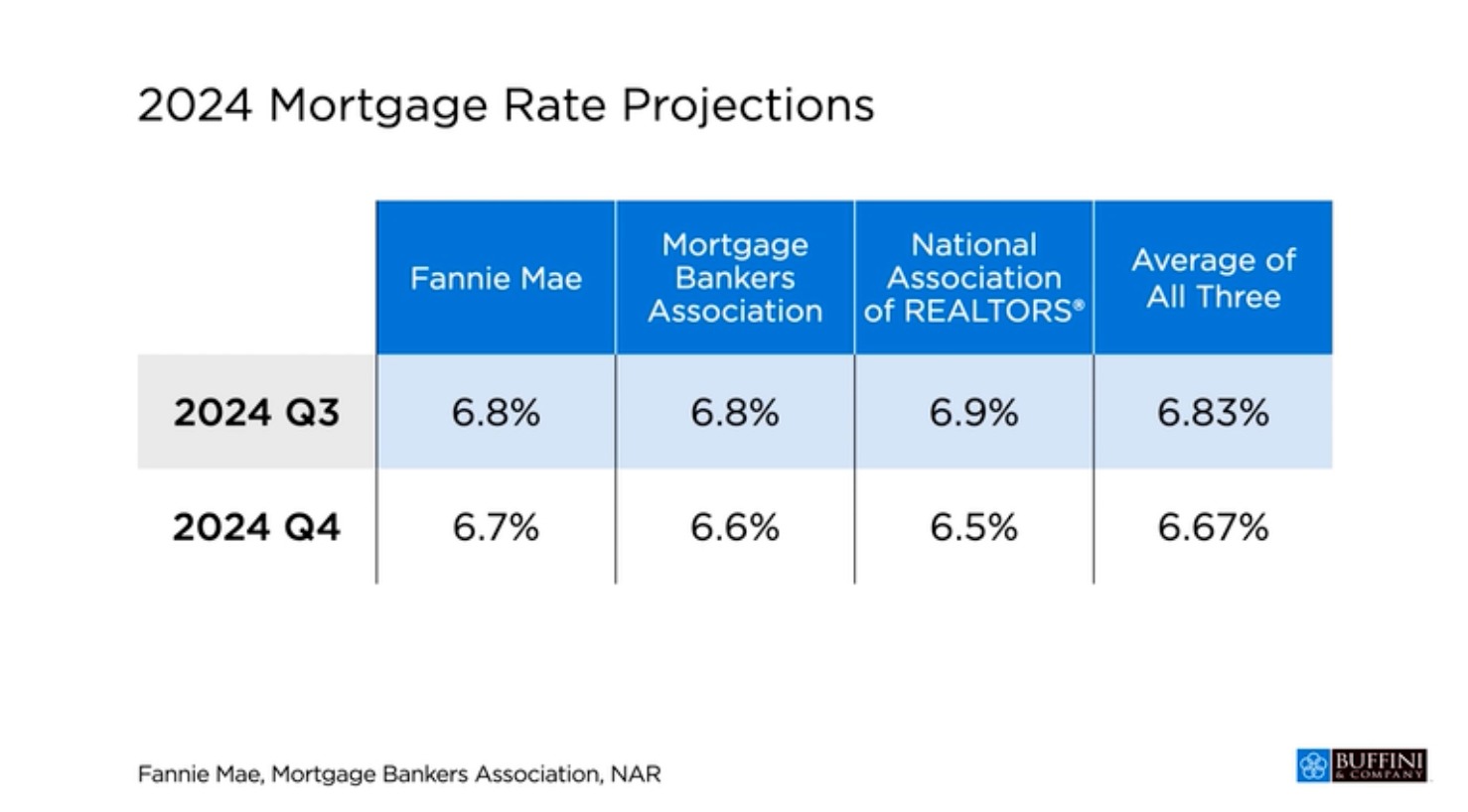

Buffini discussed his thoughts on buyers and sellers who are now becoming immune to mortgage rates as they stubbornly hovered in the 7% range over the past few months. It’s predicted that there will be one rate cut this year, with rates dropping to as low as 6.67%, with more decreases expected in 2025.

Millennial Homebuyers Will Make a Difference

Buffini also noted the impact of millennials — approximately 72 million in the United States — on the future of real estate. The average age of a person leaving the family home is 26. The average age of a first-time homebuyer is 35.

This combined group — approximately 45.5 million — is anxiously waiting on the sidelines ready to jump into the market once rates start consistently dropping, Buffini said. This generation, having navigated a landscape of economic uncertainty, student loan debt, and fluctuating job markets, is eager to establish stability through homeownership.

Their entry into the market is expected to drive significant demand, potentially revitalizing both urban and suburban areas. Moreover, their preferences for sustainable living, proximity to amenities, and smart home technologies will likely shape the types of properties that gain popularity. As rates become more favorable, the influx of millennial buyers could lead to increased competition, driving further activity in an already dynamic real estate market.

For more personalized local insights, connect with The Sherri Patterson Team as we navigate the rest of 2024 together.