For veterans in California, purchasing a home comes with unique advantages, thanks to specialized loan programs that offer competitive terms. Two of the most popular options are VA loans and the California-specific CalVet loan program. Both offer distinct benefits to veterans, making homeownership more accessible and affordable. Here's an in-depth look at these loan programs and what they mean for veterans in California.

VA Loans: A Strong Option for Veterans Nationwide

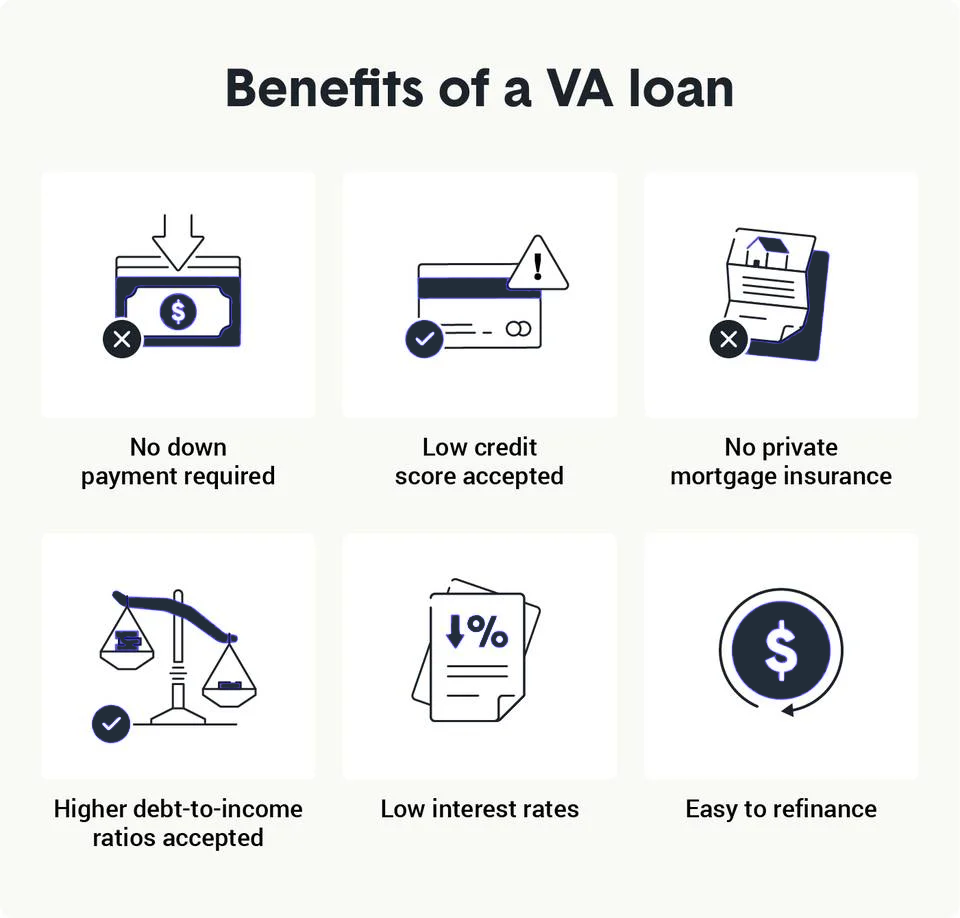

The VA loan is a benefit available to veterans across the country, but it's especially helpful in states like California, where home prices tend to be higher than the national average. VA loans come with key benefits that make them stand out compared to traditional loan options:

1. No Down Payment Required

One of the biggest advantages of a VA loan is the ability to purchase a home without a down payment. This is particularly beneficial in California, where home prices can be steep. As long as the property's appraisal aligns with the purchase price, veterans can often qualify for 100% financing.

2. Lower Interest Rates

VA loans typically feature lower interest rates than conventional loans, helping veterans save money over the life of the loan. These lower rates can make homeownership more affordable and help veterans qualify for larger loan amounts.

3. No Private Mortgage Insurance (PMI)

Conventional loans often require private mortgage insurance (PMI) when the down payment is less than 20%. However, VA loans don’t require PMI, which can result in substantial savings for veterans.

4. VA Loan Funding Fee

While VA loans don’t require a down payment, there is usually a funding fee associated with them. This fee helps keep the VA loan program running, but some veterans, such as those with service-related disabilities, may be exempt from this fee.

CalVet Loans: A California-Specific Benefit

For veterans residing in California, there is another option—the CalVet loan program. This program offers some additional benefits designed specifically to meet the needs of California veterans.

1. State-Specific Benefits

The CalVet loan program is tailored to California residents and often includes additional benefits like assistance with down payments and closing costs, depending on eligibility. These features make the CalVet loan program a good choice for veterans who may need extra help covering upfront costs.

2. Eligibility Requirements

To qualify for a CalVet loan, veterans must meet California residency requirements. The program is open to active duty service members, veterans, and certain members of the National Guard and Reserves. Veterans interested in a CalVet loan can contact their local County Veterans Service Office to get more information on eligibility and the application process.

Other VA Loan Options for California Veterans

Beyond the standard VA loan, veterans in California can also take advantage of refinancing options that could help them save even more money or access the equity in their home.

1. VA Streamline Refinance Loan (IRRRL)

The VA Streamline Refinance Loan, also known as the Interest Rate Reduction Refinance Loan (IRRRL), is a great option for veterans who already have a VA loan and want to refinance at a lower interest rate. This can lower monthly payments and reduce the overall cost of the loan.

2. VA Cash-Out Refinance Loan

Veterans looking to tap into their home’s equity can consider a VA Cash-Out Refinance Loan. This option allows veterans to refinance their mortgage and receive a cash payout, which can be used for things like home improvements, debt consolidation, or other financial needs.

Making the Right Choice for You

Whether you’re considering a VA loan or the CalVet loan program, both offer fantastic opportunities for veterans in California to achieve homeownership with favorable terms. VA loans provide national benefits like no down payment and no PMI, while the CalVet program offers additional state-specific perks.

If you’re a veteran in California and interested in learning more, The Sherri Patterson Team can connect you with top mortgage brokers in the area who specialize in VA loans. Contact us today to discuss which loan option best suits your needs. Homeownership may be closer than you think, thanks to the benefits you’ve earned through your service.