June is Homeownership Month, but many Californians wonder if they can even afford to buy a home in the Golden State. If that's you, keep reading...

Owning a home is a big part of the American Dream. But with higher interest rates and prices, is it still possible? 🤔 Don't worry! The Sherri Patterson Team is here to help. Check out our guide to making homeownership a reality in any market! 🏡✨

You can still afford to buy using these strategies...

When prices and interest rates are high, buying a home might seem daunting, but there are several strategies to make it more affordable:

- Consider Alternate Locations: Look for homes in less expensive neighborhoods or consider smaller properties that fit your budget better. The Sherri Patterson Team has a knack for finding affordable homes in desirable neighborhoods. Connect with us to learn more.

- Explore Different Mortgage Options: Adjustable-rate mortgages (ARMs) and buy downs can offer lower initial rates compared to fixed-rate mortgages. Just be aware that rates can increase over time.

- Improve Your Credit Score: A higher credit score can help you secure a better interest rate. Pay off debts and avoid taking on new ones to boost your score before applying for a mortgage.

- Utilize First-Time Homebuyer Programs: Look into federal, state, and local programs that offer grants, loans, or tax incentives for first-time homebuyers, including down payment assistance programs.

- Find Out if You Qualify For Programs That Help Lower-Income Families: Low-income home buying programs often aim to make the goal of homeownership possible by easing the burden of funding. The programs typically strive to offset and lower fees like closing costs. For example, the California Housing Finance Agency (CHFA) provides home buying programs intended to assist with down payments and closing costs.

- Negotiate with Sellers: In some cases, sellers might be willing to cover closing costs or lower the price. It never hurts to ask! A skilled real estate agent should be able to negotiate well on your behalf.

- Lock in Rates Early: If interest rates are rising, consider locking in your mortgage rate early in the buying process to avoid paying higher rates later.

- Consider Buying a Fixer-Upper: Homes that need some work are often priced lower. With some renovations, you can create your dream home while building equity. Check out this article for our advice on buying a fixer-upper in Sacramento County.

The Benefits of Homeownership

Despite fluctuations in home affordability, owning a home remains a cornerstone of the "American Dream." The appeal goes beyond simply having a place to call your own; there are numerous advantages to homeownership:

An Investment Opportunity

Owning a home is often viewed as a smart investment, offering protection against inflation compared to other investment types. Unlike assets that tend to depreciate—like cars or certain financial instruments—real estate generally appreciates in value over time. Additionally, real estate can provide tax benefits and potential rental income, enhancing its appeal as a long-term investment.

Increase Your Net Worth

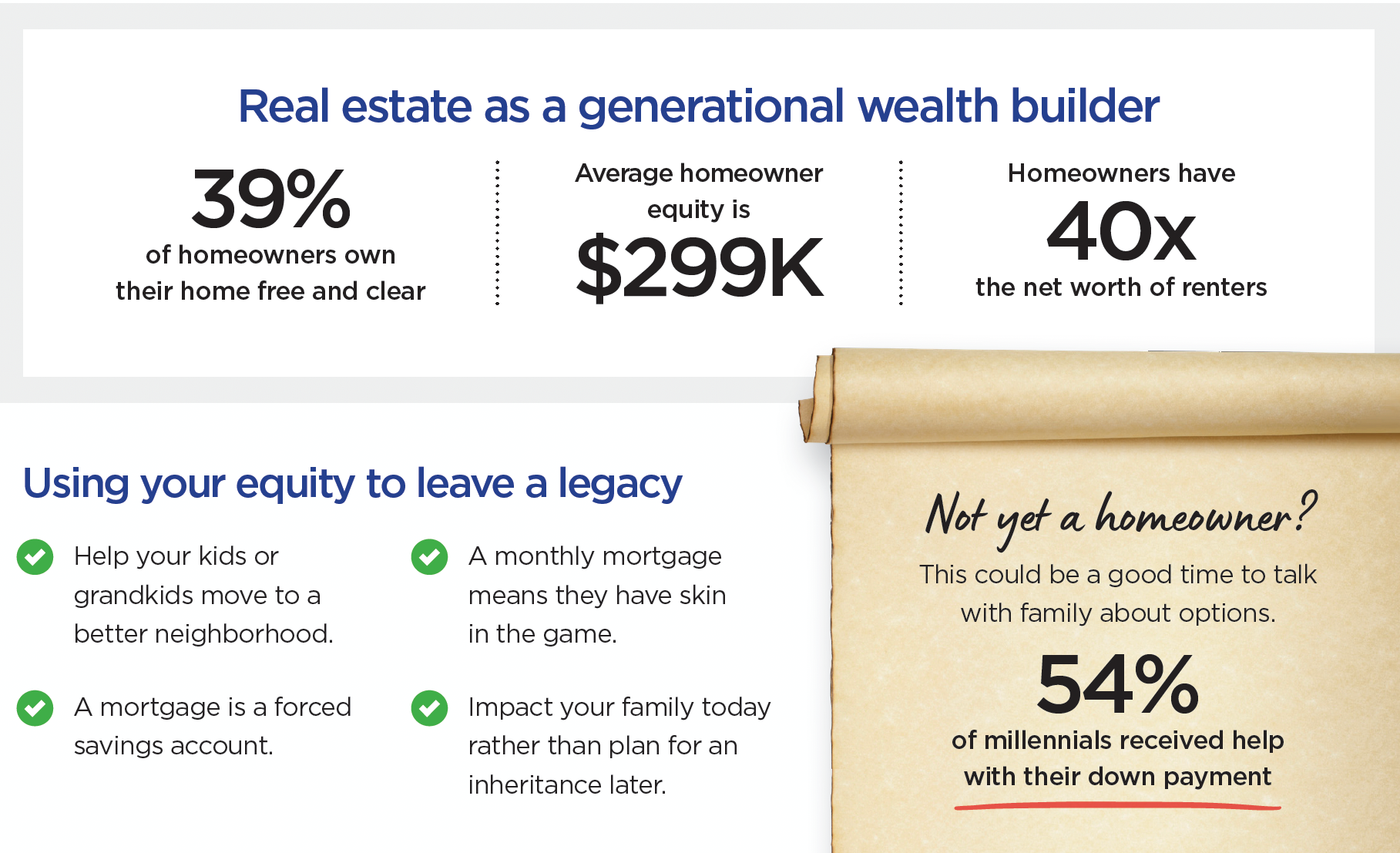

Homeownership is a powerful tool for building personal net worth. As homeowners pay down their mortgage and property values rise, their home equity increases, boosting their overall net worth. This equity can be leveraged for various financial goals, such as funding education, starting a business, or saving for retirement.

Build Generational Wealth

Another significant benefit of homeownership is the ability to build generational wealth. By owning a home and accumulating equity over time, homeowners can pass valuable assets down to future generations. This legacy provides financial stability and security for your family, ensuring they are taken care of long after you're gone. To build generational wealth through homeownership, it’s essential to maintain the property, make strategic improvements that increase its value, and develop a financial plan to preserve and grow the asset's value over time.

If affordability leaves you with questions, it’s important to remember the underlying reasons for wanting to become a homeowner. Whether your goal is to have a space to call your own, establish a stable home base for your family, or invest in real estate, the benefits of owning a home are plentiful.

If you have questions about the current market and are unsure how much home you can afford, reach out to The Sherri Patterson Team. We're here to help you navigate the home-buying process and guide you toward achieving the American Dream.